tax sale list fulton county ga

Any Bidder who fails to pay will be banned from. Detailed listings of foreclosures short sales auction homes land bank properties.

Ga Summons Fulton County Complete Legal Document Online Us Legal Forms

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Fulton County GA at tax lien auctions or online distressed asset sales.

. The fulton county georgia sales tax is 775 consisting of 400 georgia state sales tax and 375 fulton county local sales taxesthe local sales tax consists of a 300. 2435 CAMPBELLTON RD SW. Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More.

Due to renovations at the Fulton County Courthouse located at 136 Pryor. If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166. Online registrations must be verified in-person between 830 AM and 945 AM on the day of the tax sale.

These buyers bid for an interest rate on the taxes owed and the right to collect. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Fulton County GA at tax lien auctions or online. The 2018 United States Supreme Court decision in South Dakota v.

This is the total of state and county sales tax rates. 2068 GRANT RD SW. SW TG500 Atlanta GA 30303 to receive their total amount due to Fulton County Sheriffs Office.

Ad Find Tax Foreclosures Under Market Value in Georgia. Tax Sales-Excess Funds Procedure Application. Fulton County Sheriffs Office.

Public outcry to highest bidder. Please type the text you see in the image into the text box and submit. Tax Sales - Bidder Registration.

TOTAL Taxes Due. Bidders must register each month for the Tax Sale. Winning Bidder must pay by 4 pm on the 1 st Tuesday of the month.

3000 HEADLAND DR SW. Fulton County GA currently has 16 tax liens available as of March 25. View Athens - Clarke County information about delinquent tax sales including list of properties.

The Georgia state sales tax rate is currently. Atlanta GA 30303. Please submit no faxesemails the required documentation for review to the following address below.

Due to renovations at the Fulton County Courthouse at 136 Pryor Street SW tax sales will be held on the steps of the Justice Center Tower at 185 Central Avenue in Atlanta. Ad HUD Foreclosed Is the Fastest Growing Most Secure Provider of Foreclosure Listings. There are currently 761 tax lien-related investment opportunities in Fulton County GA including tax lien foreclosure properties that are either available for sale or worth pursuing.

185 Central Ave 9th Floor. The minimum combined 2022 sales tax rate for Fulton County Georgia is. Present your photo ID when you arrive to receive your bidder ID card.

The sale of Georgia Tax Deeds Hybrid are final and winning bidders. Fulton County GA currently has 201 tax liens available as of February 4. Sales tax rates in Fulton County are determined by fifteen different tax jurisdictions Atlanta Clayton Dunwoody Doraville East Point South Fulton Sandy Springs Atlanta Tsplost Tl Dekalb Co Tsplost Sp Fulton Co Tsplost Sp Milton Roswell Chattahoochee Hills Alpharetta.

15 006 01 019. Fulton County Georgia has a maximum sales tax rate of 89 and an approximate population of 973195. Foreclosures and Delinquent Taxes.

The Fulton County Sheriffs Office month of November 2019 tax sales. Tax Liens List For Properties In And Near Fulton County GA How do I check for Tax Liens and how do I buy Tax Liens in Fulton County GA. Phone 706613-3120 Fax 706613-3129.

In Georgia the County Tax Commissioners will sell Tax Deeds Hybrid to winning bidders at the Fulton County Tax Deeds Hybrid sale. Investing in tax liens in Fulton County GA is one of the least publicized but safest ways to make money in. 1980 CHILDRESS DR SW.

Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Athens - Clarke County Tax Commissioner. For TDDTTY or Georgia Relay Access.

Tax Liens List For Properties In And Near Fulton County GA How do I check for Tax Liens and how do I buy Tax Liens in Fulton County GA. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Fulton County GA at tax lien auctions or online.

Fulton county tax records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in fulton county georgia. 325 East Washington St Suite 250 Athens GA 30601. Documents necessary to claim excess funds in Fulton County below are the instructions on submissions.

6758 BROWNS MILL LAKE RD. Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. Click here for the April 2022 Tax Sale List.

Fulton County GA currently has 3190 tax liens available as of March 27. Tax information sheet situs amount 0221-47849 14-0087-0002-087-2 0 mc daniel st sw 0221-48600 14 -0145-0005-018-4 7 evelyn way nw 0221-48628 14 -0243-0004-037-9. Generally the minimum bid at an Fulton County Tax Deeds Hybrid sale is the amount of back taxes owed as well as any and all costs associated with selling the property.

Bidder ID cards will not be issued after the tax sale is under way The information entered in the following application will be used to. The Fulton County sales tax rate is. 11 248 03 020.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board. Fulton County Sheriffs Office Fulton County Georgia Justice Center Tower 9th Floor 185 Central Ave SW Atlanta Georgia 30303 Telephone 404 612-5100 Fax 404730-6684 The purpose of this memo is to provide a list of documents that will be required to the disbursement of the excess funds generated from a tax sale taking cognizance of the various applicable laws and. Surplus Real Estate for Sale.

Winning Bidder- Upon the conclusion of the Tax Sale the winning bidder will come back within 1 hour to 185 Central Ave.

Fulton County Re Openings And Service Changes

Fill Free Fillable Forms Fulton County Government

Fulton County Ga Property Data Real Estate Comps Statistics Reports

Fill Free Fillable Forms Fulton County Government

Faqs Fulton County Superior Court Ga Civicengage

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc

Best Places To Live In Fulton County Georgia

Fulton County To Add Additional Tag Renewal Kiosks In Atlanta

Sell Me Your Home Local Investment Company Looking For Properties In The Following Ga Counties F Home Buying Process Investment Property Distressed Property

Fill Free Fillable Forms Fulton County Government

Fulton County Board Of Assessors

Fulton County Census Tracts By Level Of Likely Reo Investor Ownership Download Scientific Diagram

2022 Best Places To Buy A House In Fulton County Ga Niche

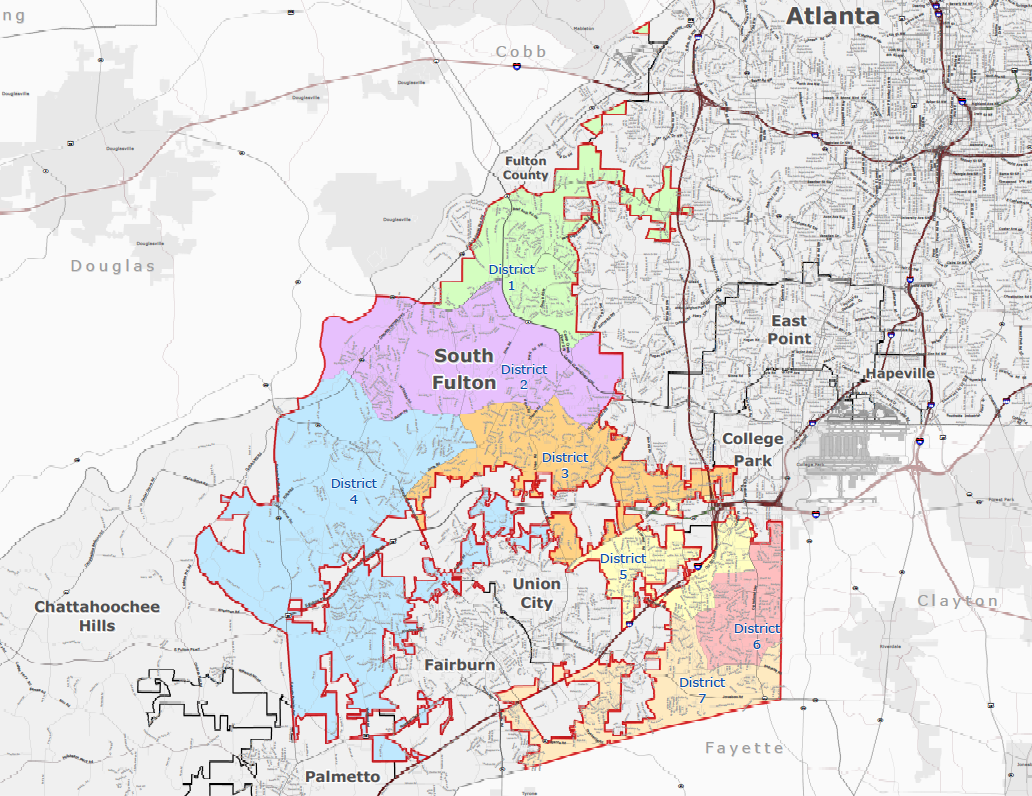

City Of South Fulton Ga South Fulton 101

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Faqs Fulton County Superior Court Ga Civicengage